The Fed is widely expected to announce an increase in its target Fed Funds Rate at the upcoming FOMC meeting (Dec. 15-16). After seven years of near-zero interest rates, the Fed’s move will signal the beginning of “liftoff”—an end to a lengthy period of crisis response marked by quantitative easing and easy money, and a return to a more typical monetary policy with above-zero interest rates. The expected move has sparked considerable debate, but mostly about timing. Some observers believe that the Fed should wait until domestic labor markets are healthier, inflation rises beyond current modest levels, or emerging-market countries are on more stable footing. But few of my academic colleagues are discussing what I believe is the most interesting facet of the Fed’s move: the Fed’s balance sheet is now so large that raising interest rates is logistically and mechanically challenging. The Fed must get creative, and its strategies in the coming months could have important economic and political implications for financial stability and the centrality of the Fed Funds market for the conduct of monetary policy.

To see why, let’s start with the basics of U.S. monetary policymaking in normal times, and then we’ll see how things work after quantitative easing. Warning: this is a lengthy post! If you want to bypass all the gory details, jump to the numbered list at the end.

Basics of the Fed Funds Market

When a bank accepts a deposit, it must place an amount equal to a small fraction of the deposit in its account at the Fed. This is the so-called reserve requirement, and the funds placed at the Fed are called required reserves. Banks are continually adjusting their required reserves as the amount of their checkable deposits changes. Banks that need some extra reserves at the end of the day to satisfy their reserve requirement can borrow overnight from banks with extra reserves in the Fed Funds market. The average interest rate of these overnight loans is called the Fed Funds rate. And because this is a closed market, the Fed can adjust the total volume of reserves in the system through open-market operations (voluntary sale or purchase of treasury securities to/from banks). If reserves become scarcer, the overnight rate rises. And if rates are a bit higher, a bank will charge customers a little bit more for a loan in anticipation of paying a little bit more for required reserves.

The Fed’s usual strategy is to target the Fed Funds rate by adjusting the level of reserves in the system. This has been a straightforward endeavor for decades, such that few of us would ever think to look up the actual Fed Funds rate on Bloomberg (but indeed, it always varies slightly from the Fed’s target). In typical times, if the Fed announces a rate increase, it sells treasury securities via auction to banks; banks pay for the securities using their reserves, thereby shrinking total reserves and inching up the Fed Funds rate to the desired target.

After Quantitative Easing: A New Challenge for Raising Rates

In response to the global financial crisis, the Fed purchased large quantities of securities in the open market in a process known as quantitative easing. Reserve levels increased to the point that the Fed Funds rate was effectively zero, but the Fed didn’t stop there – it continued to purchase securities of various maturities to reduce borrowing costs throughout the entire economy. The result was that total reserves ballooned to unprecedented levels, from around $40 billion before the crisis to more than $2.6 trillion today. More than 95 percent of these funds are excess reserves, meaning that they exceed the amounts that banks must hold to satisfy the Fed’s reserve requirements. Not surprisingly, trading in the Fed Funds market has become quite thin because most banks have plenty of reserves at the end of the day.

Now that the Fed wants to raise the Fed Funds rate, these excess reserves pose a conundrum. If the Fed followed its typical strategy of draining enough reserves to raise the rate, it would have to sell trillions of dollars’ worth of securities in a very short time. Doing so would wreak chaos upon the entire financial system. The economists at the Fed are well aware of this problem, and therefore standard open-market operations are off the table. What else can the Fed do?

The Fed Gets Creative

The Fed has two additional tools at its disposal. The first, interest on excess reserves (IOER), is straightforward to understand. The second tool, the reverse repurchase agreement facility, requires a bit more explanation.

Interest on Excess Reserves (IOER)

In 2008, the Fed began paying interest on banks’ excess reserve balances. The modest 0.25 percent IOER was designed to allow the Fed’s balance sheet to expand without losing complete control over the Fed Funds target rate. The IOER, in theory, provides a floor for the overnight rate: if a bank can earn a risk-free 0.25 percent on its excess reserves, it has no incentive to lend them overnight for less.

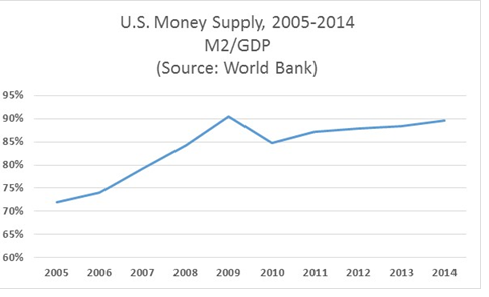

A quick aside: an underappreciated goal of IOER is to discourage bank lending. In normal times, excess reserves represent an opportunity cost for banks, which generally prefer to issue loans and reclassify those funds as required reserves rather than leave them sitting idle. The IOER therefore affects banks’ marginal propensity to lend. A positive IOER discourages lending; a negative IOER (as recently imposed by the European Central Bank) encourages lending. For the U.S., notice that the money supply (M2) hardly budged from its trend line in 2008-9 and then tapered off (see below). This hardly constitutes “debasement of the currency” as some politicians claimed at the height of the Fed’s QE policies. The Fed’s decision to impose IOER helped ensure that successive rounds of QE did not trigger a lending boom. (Banks’ own reluctance to lend during a prolonged downturn also played a role.) In contrast, for Europe the hope is that the money supply will expand above trend in the coming months as the negative IOER spurs more bank lending.

My sense is that Fed officials hoped that IOER would suffice as a monetary-policy tool, but recent experience suggests that IOER does not function reliably as a floor for the Fed Funds market. The average Fed Funds rate hovers around 0.13, or roughly half the IOER. This discrepancy was a mystery to me until I discovered that Federal Home Loan Banks (FHLBs) are major players in the Fed Funds market. (See Who’s Lending in the Fed Funds Market at the New York Fed’s blog.) FHLBs are ineligible to receive IOER, and are therefore willing to lend their excess reserves at virtually any positive interest rate. Their participation pulls down the average Fed Funds rate below IOER.

Reverse Repurchase Agreements

For the past several months, the Fed has experimented with a less well-known tool in its toolkit: reverse repurchase agreements. In simple terms, a reverse repo is an overnight loan from a financial institution to the Fed. The Fed accepts the funds, backs them up with Treasury securities as collateral (so they are a super-safe investment), and returns the funds the next day with interest. This is a great deal for eligible financial institutions with extra cash lying around. But more importantly for monetary policy, reverse repos are a potentially effective monetary policy tool if they are made available to a broad enough pool of financial institutions.

The Fed recently announced that it would massively expand the set of eligible counterparties for the reverse repo facility. The list now includes money market fund managers like Schwab and Fidelity, a range of banks (including New York branches of foreign banks), Fannie and Freddie, and the FHLBs. There are two important implications of this expansion, assuming the program is successful. First, the reverse repo rate will serve as a critical influence on short-term markets. No eligible lender would lend overnight at less than the reverse repo rate – and given the breadth of eligible lenders, this implies that reverse repos will have systemic consequences on short-term borrowing costs. And second, the reverse repo rate will serve as a floor for the Fed Funds rate. Remember when I mentioned that the FHLBs are key players in the Fed Funds market, and they pull down the average interest rate because they do not receive IOER? Well, FHLBs are included as eligible counterparties in this new reverse repo program, so as soon as the program commences, they too will have no incentive to lend at less than the reverse repo rate in the Fed Funds market.

So there we have it. In the coming months and years, the IOER rate will serve as the ceiling, and the reverse repo rate as the floor, in the Fed Funds market.

Now let me spell out what I find interesting:

- It takes an enormous reverse repo program to move a market as large as the short-term money market. The original plan was to cap the program at $300 billion and limit any individual counterparty to $30 billion. The Fed successfully tested a pilot program with these limits (see Simon Potter’s speech earlier this year), which means that the Fed Funds rate reliably tracked increases or decreases in the reverse repo rate. But today there is uncertainty as to whether a program capped at $300 billion is sufficient to move the Fed Funds rate from its current target of 0-0.25 percent to 0.25-0.50 percent. Over the past few months, this uncertainty has led many market participants to tell the Fed to “get on with it already” and raise rates, just so that markets can be assured that the Fed still has the capacity to do its job. The Fed itself is concerned about its abilities; as Potter noted in his speech, FOMC participants “all agree that demonstrating sufficient control over money market rates during the critical early stages of policy normalization is a priority.”

- Because of #1, after “liftoff” all eyes will be watching the Fed Funds rate (and biting their nails) to see if the Fed hits its target. You thought monetary policymaking wasn’t suspenseful?

- Also because of #1, we have an underappreciated justification for raising rates now, contra some of my colleagues who have thoughtfully urged caution in light of shaky labor markets or foreign instability. (See Sarah Bauerle Danzman and Kindred Winecoff’s Monkey Cage contribution. or any recent column by Paul Krugman.) I’m also wary of premature action by the Fed, but I think it should move forward now with a modest rate increase and hold it there until economic indicators suggest further tightening is warranted.

- There is a “Goldilocks” problem with the reverse repo program. If the program is too small, it won’t move the markets. If it’s too large, it could disrupt (or distort) the markets in times of stress. A little bad news could send financial institutions running to the Fed as a safe haven, thereby drying up the overnight market for other financial institutions that might desperately need cash. Remember how the interbank market froze when Lehman Brothers collapsed? Now imagine how quickly things could go south if $300 billion (or more) in short-term funding could be suddenly diverted from banks to the Fed in a flight to quality. Is this a legitimate concern? No one really knows whether the reverse repo facility could threaten financial stability, but people are definitely worried. (See Sheila Bair here.)

- The Financial Stability Oversight Council (FSOC), established by the Dodd-Frank Act, is responsible for identifying risks to U.S. financial stability. Will the FSOC examine the stability implications of the reverse repo program? Such a move could be politically complicated. We don’t normally think of the central bank itself as an instigator of activities that might need to be curtailed in the name of financial stability. Moreover, the Fed Chairman is a voting member of the FSOC, so there is a conflict of interest. The bureaucratic structure of these things really matters. And would an FSOC investigation violate the Fed’s independence? These are all important questions for my fellow political scientists.

- The Financial Stability Board (FSB) is leading an effort to designate certain large non-bank financial institutions as “systemically important financial institutions” (SIFIs) whose distress could cause significant disruption to the broader financial system. The FSB recommends that SIFIs maintain larger capital cushions and undergo more intensive scrutiny by national regulators. Many (most?) of the newly eligible counterparties in the Fed’s reverse repo facility could be classified as SIFIs. Understandably, they are lobbying feverishly to prevent this from happening, and they have thus far been successful at warding off new regulatory requirements. But if they become regular participants in the Fed’s reverse repo program, lending upwards of half a trillion dollars a day so that the Fed can hit its Fed Funds target, then it will become clearer that their stability is critical for the conduct of monetary policy. That sounds “systemically important” to me.

- The European Central Bank recently embarked upon its own version of quantitative easing, arguably several years later than it should have. When the ECB is ready to unwind (probably several years from now), how will it proceed? I suspect the European overnight market is leakier than the Fed Funds market, which makes me question whether a positive IOER would be an effective tool for the ECB. Does the ECB have the authority to engage in a wide-scale reverse repo program throughout the Eurozone? If not, what other tools can it use, and will they be politically acceptable?